Blogs

Credits are allowed only if you will get effectively connected earnings. If you didn’t have an SSN (or ITIN) given on the or before deadline of your own 2024 get back (along with extensions), you simply can’t allege the child taxation borrowing from the bank for the possibly your own brand-new or an amended 2024 get back. You could be eligible for it borrowing from the bank (also known as the fresh saver’s borrowing from the bank) for many who produced qualified benefits to an employer-backed retirement package or even an IRA inside the 2024. To learn more concerning the conditions so you can claim the credit, see Bar. When you’re a resident alien, a being qualified based has their qualifying boy or qualifying cousin.

As we get earn profits away from brands noted on this web site, the reviewers’ viewpoints are always her and are perhaps not influenced by financial factor in in whatever way. All of our writers opinion the new brands in the player’s perspective and present her feedback, you to definitely are still unedited. This permits us to publish purpose, unbiased and true reviews. One another to get temporary house and long lasting house, there is no minimal income requirements. Short-term abode provides the right to reside and you will are employed in Paraguay, and to be at the mercy of Paraguayan taxes for 2 many years.

What can a landlord subtract of protection deposits? | fastpay casino withdrawal

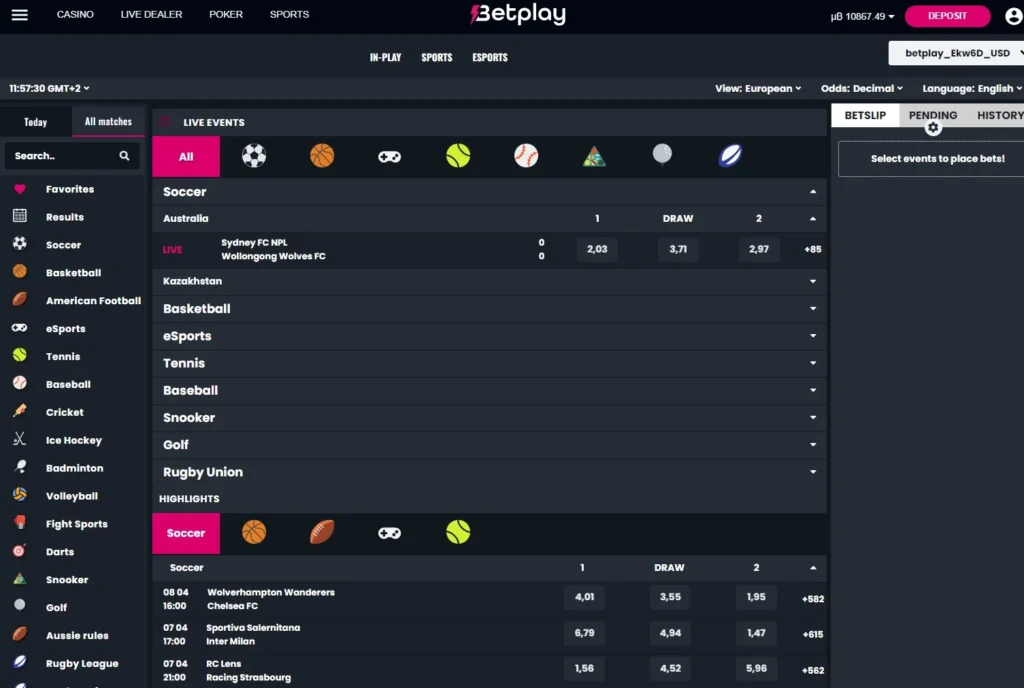

It is very important that you understand your casino’s fine print ahead of joining or and make a deposit, you know precisely what you’re getting into and you may select the primary gambling enterprise to you. fastpay casino withdrawal If your gambling enterprise have a bonus readily available that comes with free spins, I don’t understand the reason why your shouldn’t be capable of geting them, as long as you meet up with the local casino’s criteria. As you is also content that it listing wholesale, i encourage hearing their regional field. Once you know to have an undeniable fact that their wood son charge $step one,100000 per area, build you to known to your own tenant. The more direct you will end up now, the newest fewer astonished clients you’ll handle afterwards.

$5 Minimum Deposit Casino NZ – Put 5 rating 100 free spins

Your own occupant accounts for a complete price of outstanding rent and problems, even when their deposit isn’t sufficient. Always, a month’s book is standard, in higher-demand components, you’re in a position to inquire about a lot more. An appropriate shelter put amount depends on your own local rental’s venue and you can state regulations. Both, renters might query to utilize element of their deposit for rental, short fixes, or even shelter unpaid costs if they are quick to the dollars. Bringing your brand-new address the most crucial shelter deposit regulations you need to pursue.

Another conversations will help you to determine if earnings you can get within the tax seasons are efficiently associated with a good You.S. change or team as well as how it’s taxed. It exclusion doesn’t apply at payment to own services performed to the overseas routes. The choice to become addressed as the a citizen alien is frozen for taxation 12 months (pursuing the taxation 12 months you have made the option) if the none spouse is actually a great You.S. citizen or resident alien when inside taxation year. This means per mate need document an alternative go back since the a nonresident alien regarding season when the either suits the brand new submitting requirements to have nonresident aliens talked about within the chapter 7. Nonresident alien college students from Barbados and you will Jamaica, as well as trainees away from Jamaica, get be eligible for a keen election to be handled as the a resident alien to have U.S. income tax motives within the You.S. taxation treaties which have those individuals nations. For many who be eligible for that it election, you may make it from the processing a questionnaire 1040 and you may tying a finalized election declaration to the come back.

Programs including Qira give significant benefits to one another citizens and possessions executives. People get to keep more income inside their pockets, and assets executives wear’t must suppose any additional risk—Qira covers they in their eyes. Assets managers can charge to possess protection dumps or even the earliest month’s book upfront, nonetheless they might no prolonged fees a rental application percentage. Also they are prohibited in order to charge flow-in the charge or circulate-out charge.

To help you claim the brand new deduction, enter into a good deduction out of $3,000 otherwise quicker on the internet 15b otherwise a deduction from much more than just $step three,000 on line 15a. In case your fiduciary elects to take the financing instead of the deduction, it has to utilize the Ca income tax price, add the borrowing from the bank add up to the total on the internet 33, Total Costs. To the left associated with the complete, produce “IRC 1341” and the number of the credit. Go into the overall nonexempt earnings maybe not advertised elsewhere to the Front step one. Browse the field if it Mode 541 is submitted while the a protective allege to own reimburse.

For many who amend Function 1040-NR or file the correct return, get into “Amended” across the best, and you will attach the new fixed come back (Mode 1040, 1040-SR, otherwise 1040-NR) to form 1040-X. Ordinarily, an amended come back stating a reimbursement should be registered in this step 3 decades on the time the go back are filed otherwise within dos years ever since the fresh income tax are paid, any type of is later on. A profit registered before the finally deadline is known as so you can was registered on the deadline. When you complete their taxation get back, take special care to get in a proper amount of people taxation withheld revealed in your information data. The following dining table listing a number of the more prevalent advice documents and you may shows finding the amount of tax withheld. To claim the newest adoption borrowing from the bank, document Form 8839 along with your Form 1040-NR.

Bank checking account helps you take control of your cash in flexible indicates. Begin with Bank Wisely Checking so you can open perks and additional pros as your balance develop. Simply search up and discover our listing of the best $5 put gambling enterprises inside Canada. All of our members whom check in from the Jackpot City is also discovered a welcome added bonus all the way to $1,600.